Hey DYD Team! Hope you’re excited for the following post. Look to the right of your screen - see how small the scroll bar is? Yeah…this is one of our longest posts ever. What started as an attempt to broadly outline the cannabis industry has quickly mutated into a 6,196 word, 29-minute read on EVERYTHING cannabis…and this is only part 1!

I’m giving this disclaimer to say - nay, beg - that you don’t read this all in one sitting. this piece should be viewed as a resource for any time you’re considering investing in cannabis. any questions you have are answered below, and if you have more, please reach out! my email is at the bottom of this post.

Lastly, stay tuned for Part 2 - coming exactly one week from today! Part 2 will include the fun stuff, such as Stock Picks, Price Targets, and all the ways you can actually make $$$ from this industry. cheers!

Roughly 2,500 years ago, a group of people at an otherwise mundane burial ground located in the eastern region of the Pamir Mountains in modern-day Xinjiang, China officially became humanity’s first confirmed stoners.

And roughly 3 years ago, in the modern-day United States, a group of 48.2M people continued this tradition, using cannabis at least once in 2019.

For such a small and seemingly insignificant collection of plants, the Cannabaceae family, from which cannabis is derived, sure has received more than its fair share of attention from we humans. Over the past 2.5 millennia, various cultures across the globe have used cannabis for a plethora of reasons. Acting as the lubricant for religious ceremonies in one society while simultaneously being used on a daily basis for enjoyment by others, it’s clear that this stuff is a bit of a rabble-rouser.

Yet, despite such a storied and relevant history, it’s only in the past half-century or so in which cannabis has become as stigmatized as saying “the Earth is round” in 16th century Europe. I mean, taxpayer-funded D.A.R.E officers across the U.S. are hired with the explicit, primary goal of scaring 11-14 year-olds into thinking weed = satan. We hate this plant so much that our government has and continues to throw its own citizens in federal prison for daring to smoke a J. Seems like a little much, no?

Without getting into the near atrocities committed by the U.S. and other governments in the various wars on drugs throughout the 20th century, it’s finally safe to say that legislatures are gradually starting to sober up around drug policy. 19 states across the U.S. have legalized recreational marijuana use while Colorado and Oregon have even gone as far as decriminalizing drugs like psilocybin and MDMA. In Portugal, all drugs have been decriminalized since 2001.

The trend is clear; societies worldwide appear to be slowly but surely mean reverting back to the days of cannabis use not being a very big deal. Since President Joey B stepped into the Oval with a Democrat-filled House and Senate, potheads from sea to shining sea have felt rejuvenated optimism at the prospect of nationwide legalization (or at least, decriminalization). While that isn’t coming anytime soon, the long-term trends are clear and the financial opportunity associated with non-illicit cannabis use is simply too large (and too fun) to ignore.

And that’s what brings us here today. People love getting high and we all love seeing our portfolios get high too - but now, we have the chance to kill two birds with one stone. Welcome to DYD’s deep dive into the cannabis industry and investment opportunity(ies) it presents.

Regulatory Background & Overview

Like we said, cannabis consumption goes back at least to the 3rd-century B.C.E. In all reality, humans have likely been friends with Mary Jane for much longer and we just don’t know it yet. Some reports indicate use going as far back as the 9th-century B.C.E on the Indian subcontinent, but that’s a little too far back for our purposes.

Today, all we care about is how this ancient plant can make us money. Now, despite the fact that possession of this substance on federal land is punishable by one year in prison and a $1,000 fine, the United States obviously still allows degens like us to profit off of it. Let’s find out how.

Regulatory Environment

Much like maple syrup and hockey, the story of investing in cannabis begins in Canada. Well, kinda (not really) - just allow me to elaborate.

On October 17, 2018, the Canadian government formally legalized, regulated, and restricted access to cannabis. While it wasn’t the first country to legalize the drug (shoutout to Uruguay in 2013), it was the first G20 and G7 nation to do so, making this regulatory change the spark of the first large-scale opportunities for investors eyeing the industry.

Strangely, there were publicly traded weed stocks on both Canadian and U.S. markets prior to our northern neighbor's legalization. That’s pretty counterintuitive, so understanding the regulatory profile and legality of publicly-traded cannabis stocks has to be discussed. Don’t worry, we’ll get there in just a bit.

To make the biggest understatement I possibly could, the legal classifications within the cannabis industry - with all its disparate legislation across a growing set of geographies - are complicated. The difference between, for example, recreational dispensary licensing requirements in Massachusetts vs Manitoba vs Montevideo, is certainly relevant to investors looking to get deeply involved in the space. But, this would require far too much time and cause an epidemic of boredom among DYD readers. Instead, we’ll optimize this breakdown from an investing perspective.

Essentially, there are two different forms of regulatory entities in which investors can find “pure-play” cannabis opportunities: Canadian Licensed Producers (LPs) and U.S. Multi-State Operators (MSOs). Time to check them out.

Canadian Licensed Producers (LPs)

According to the Canadian government, there are 867 various kinds of licensed operators within the country’s cannabis sector. To get a little more specific, let’s try to understand these different players and their roles.

Broadly, a licensed producer refers to “any licensed company in the Canadian cannabis industry” (CA Gov’t). From there, the industry is further segregated, with the current system beginning in October 2019. The established sub-classifications include:

Cultivators: Refers to organizations that grow, harvest, produce, and propagate raw cannabis seeds and flowers. In addition, cultivators are also authorized to possess, test, and sell marijuana.

Processors: Included in this category are organizations in the “next step” of the cannabis-sale process. Processors are involved in possession, production (other than by synthesis, cultivation, and harvesting), and sale of cannabis products.

*most dispensaries are required to maintain both cultivator and processor licenses*

Sale for Medical Use: This one is pretty obvious. The aptly named category covers those involved in the sale of cannabis to medical organizations, such as hospitals, medical dispensaries, and others.

Testing Cannabis: Contrary to popular belief, cannabis testers are not just a group of stoners giving various strains a rating out of 10. In fact, cannabis testers in Canada are simply authorized to possess the drug as well as to alter its chemical and physical properties.

Research Using Cannabis: Like testers, researchers have similar authorizations but serve different purposes. Rather than testing for companies and organizations seeking to sell the plant, researchers simply conduct discretionary research on cannabis.

As you can likely tell, the first three classifications of LPs are the most pertinent to investors. Across the range of different players, costs associated with regulation vary widely. For most cultivators and processors, annual license costs run up to at least $25,500.

Moving outside of Syrupland, there is a vibrant cannabis industry burgeoning in Canada’s southern neighbor. No, weed isn’t legal in the U.S., but a few of the cool-kid states have used two memos from the DOJ to essentially give the finger to the feds.

Multi-State Operators (MSOs)

The 2009 Ogden memo and the 2013 Cole memo both provide basic outlines for how states can regulate the sale of both medical and recreational marijuana. Still, it’s important to note that at literally any moment, the federal government does have the ability to enforce the Controlled Substances Act and shut the whole party down. Fortunately, thus far, our governing overlords haven’t been total narcs…yet.

And that lack of a 21 Jump Street vibe from Washington has been the key to allowing the fragmented yet thriving U.S. cannabis industry to emerge. A little different than Canada, let’s understand how things work in the U.S.

Formerly a general term used in any industry, the term “multi-state operator” has been almost totally hijacked by the cannabis industry. There really isn’t any formal, legal definition for the term, but it’s come to refer to cannabis companies who hold and maintain licenses to operate in at least two states.

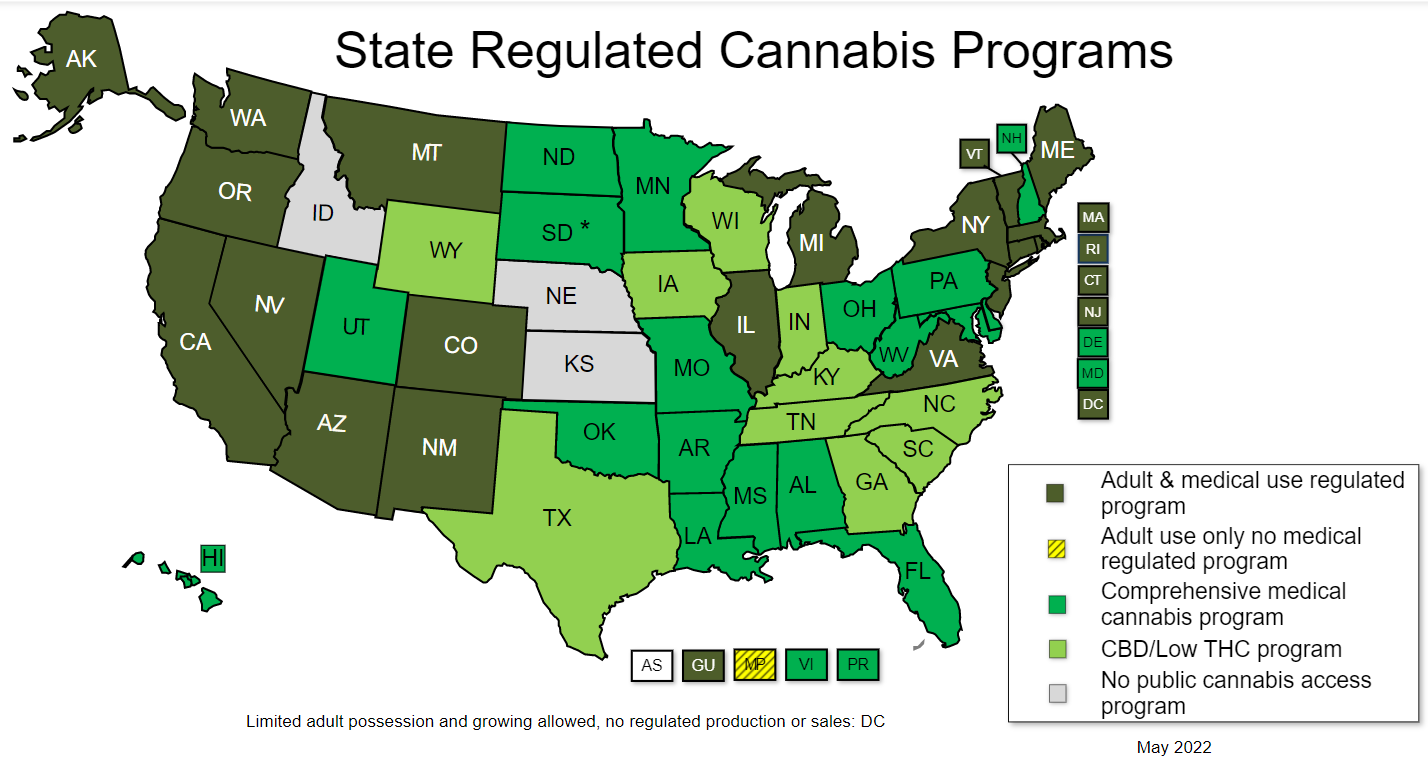

Unlike Canada, there’s no nationwide classification system outlining the necessary authorizations needed by different players in the industry. Obviously, that’s because weed is still illegal in D.C.’s eyes, but for a state-by-state breakdown, the image below provides the optimal perspective:

Source: National Conference of State Legislatures

In classic U.S. government form, there exists an insurmountably complicated hodgepodge of rules, regulations, and of course, bureaucracy in all of these states. We’re not gonna get pedantic and go state-by-state to analyze their own regulations, but we can generalize.

In each of the 19 cool-kid states, there are basically four cannabis-specific taxes to be aware of 1) cultivation tax 2) medical tax 3) excise tax and 4) wholesale tax. Not all states check each box, such as Montana and Nevada having no cultivation tax or how MassTaxachusetts surprisingly doesn’t charge a wholesale tax, but they certainly provide a lot of trouble.

That’s because the trouble comes where these taxes build up. In Virginia, the industry pays Uncle Sam a simple 21% for all cannabis product sales. But in California, cultivators pay a tax, adding costs early in the supply chain, and then dispensary customers still pay a 15% excise tax, a 7.25% sales tax, and any local taxes that apply.

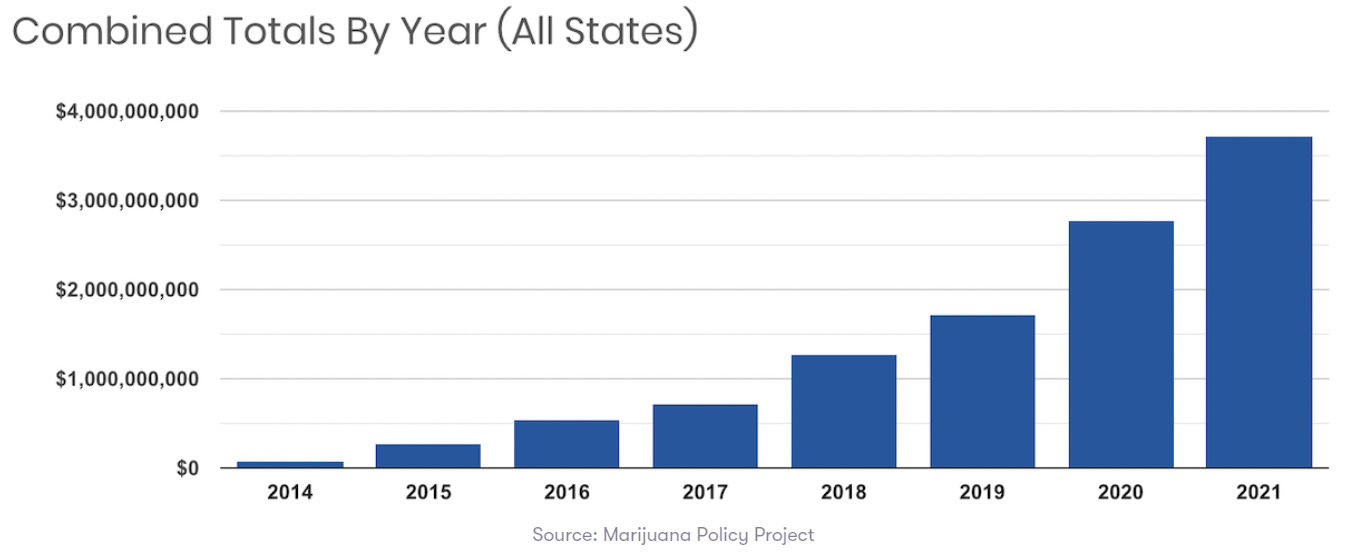

Clearly, states right now have little interest in driving a cost advantage for legal sales. But as the industry grows and becomes less stigmatized, this added pricing pressure will only trend down. I mean, if states continue to see tax revenues from the industry like this, that’s a golden goose they sure won’t want to kill.

To finish off this broad regulatory overview, it’s important to discuss what the future for cannabis could be on the federal side. As of now, there exist a few pieces of proposed legislation floating around Washington. Let’s take a peek.

Proposed Federal Legislation

This might get a bit confusing but stay with me here. Weed is illegal in the eyes of the U.S. Government - but if I wanted to - I could drive 15mins down the road, show my state-issued ID, purchase the drug, pay taxes on that purchase, and drive home without worry of an ensuing police chase.

How is that possible? Well, basically it comes down to the framework of U.S. federalism and the evergreen battle between state and national regulations.

For starters, the 10th amendment gives us a little wiggle room as it says:

“The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

In other words - “any subject not covered in the Constitution or banned by the federal government is up to the states.” James Madison didn’t say anything about smokin’ weed in the Constitution, but it is banned at the federal level. So wtf?

Well, it all goes back to those memos referenced earlier from former Deputy AGs David Ogden and James Cole. Essentially, the piece that allows states to legalize weed comes from these two instructing the DOJ to look the other way. These memos simply tell the Justice Department to not prosecute or crack down on the (legal) cannabis business in states that have voted to legalize medical or recreational weed. That’s it.

But still, marijuana is clearly on its way off the Schedule 1 drug shelf. 60% of Americans want to see both recreational and medical marijuana legalized, while 31% of Americans support medical legalization alone. That means that over 90% of U.S. adults are pro-legalization in some form or another. Moreover, younger Americans strongly over-index in support for legalization, meaning as Gen Z and millennials garner more political power, the odds of legalization only increase. (source for stats)

But for now, cannabis remains as illicit as meth at the federal level. However, there at two pieces of legislation in Washington seeking to shake up the current state of American marijuana. These include:

H.R. 3617 - Marijuana Opportunity Reinvestment & Expungement (MORE) Act:

In 2020, the House of Representatives introduced, voted on, and passed the MORE Act. Unfortunately for cannabis companies, the Senate never took up the bill and its chances of becoming law stopped there.

But like Rich Strike in the Kentucky Derby, the House came out of nowhere in 2021, reintroducing the bill for a contentious Round 2. Now that MORE is back on the table and through the House again already, it’s important to understand what could come. Even if the bill is not passed in its exact, current form, it helps to understand the framework by which Congress intends to regulate the industry.

Basically, the MORE Act does just a few, yet very crucial, things. The main points from a purely financial perspective include:

Allows the SBA to make loans to “legitimate” cannabis-related companies

Imposition of a federal excise tax on cannabis produced or imported in the U.S.

Imposition of an occupational tax on production facilities & import warehouses

MORE does a lot…more…than just those points, however. The remainder of the legislation primarily deals with supporting the social consequences of the War on Drugs and ordering agencies to study and publish data on the effects of legalization. All very important, but won’t affect the $ that I invest in the space.

If enacted into law, this bill would essentially make cannabis a legal market in Uncle Sam’s eyes. And what better way to celebrate that legitimacy than by levying taxes?

This would allow institutional dollars to flow into the space, federal banks to open accounts for as well as lend to cannabis companies, and eliminate the risk of potential raids of cannabis facilities by the feds. So despite increased taxation, the cannabis industry is begging for this bill to get passed.

Woefully, however, we’ll likely be waiting a while to see this become law. 60 Senate votes are needed to end the filibuster and take this bill to the floor in the upper chamber of Congress. But given the current makeup of the Senate along with projections for shake-ups in both chambers following midterms, that ain’t gonna happen in 2022.

Fingers crossed for 2024. President Biden did say in October 2020 that “We should decriminalize marijuana…I don’t believe anybody should be going to jail for drug use.”

Next…

H.R. 1196 - Safe and Fair Enforcement Banking Act (SAFE) Act:

Similar to the above bill, the SAFE Banking Act essentially seeks to legitimize the cannabis industry. Right now, activities in this industry are considered unlawful by the federal government, and thus national banks and depository institutions consider cannabis businesses persona-non-grata.

The fundamental elements of the bill include:

Prohibits regulators from penalizing depository institutions for providing banking services to cannabis-related companies

Proceeds from activities in the cannabis industry are no longer considered “unlawful”, meaning these proceeds would not be subject to AML laws

Depository institutions are no longer liable or subject to asset forfeiture for providing loans or other services to cannabis-related businesses

Of course, there are a few other elements to this bill, but they’re a little too technical for our purposes.

This bill can be thought of along the same lines as the MORE Act with the main difference found in MORE’s focus on promoting social justice. The SAFE Banking Act seeks to legitimize the cannabis industry as well, but this bill’s focus is strictly financial in nature.

That strict adherence to financial legitimacy likely will make this bill easier to pass through Congress. Still, it won’t be an easy path or come anytime soon, but the lack of social justice initiatives present will make garnering support from both sides of the aisle an easier task.

To paraphrase Neil Armstrong, this Act would be one small step for Congress, but one giant leap for the cannabis industry.

Okay, glad that’s over. Now that we all understand the regulatory landscape, we can start talking about the financial opportunity(ies), products, market dynamics, and risks present in this proliferating space.

Let’s keep this party goin’.

Industry Overview

In 2021, the global legal cannabis market generated a total of $16.5bn in sales, according to New Frontier Data. Sure, that’s only about 11% the size of Berkshire Hathaway’s cash balance, but like other weeds, this one’s all about growth.

According to the same source, global sales are projected to climb at a nearly 20% CAGR through 2025. Compared with other estimates, a 20% CAGR is decidedly on the low end. Grandview Research puts the 2022-2030 CAGR at 25.3% while other estimates get as high as 28% or even 32%.

That suggests that, by 2030, the global legal cannabis market will command a space registering sales in the range of $85bn - $94bn annually, if we assume continued growth. Even the most conservative estimates I could find for growth suggest at least a tripling in size from where we are now.

But I doubt I have to prove to you that the legal cannabis sector is set for some decent growth. What I do want to discuss, however, is all the different ways you can get a piece of that and the risks that come along with. Time to head deeper.

Cannabis Products

According to DrugPolicy.org, there are four broad ways of ingesting weed, including: inhalation, oral, sublingual, and topical. Frequent users will note that there are (definitely) more than four ways to get high, but each of those methods can be placed into one of the above categories.

For investors less familiar with marijuana products, examining a company’s offerings can easily get confusing. The cannabis industry, like finance, is jargon-laden and expansive in its products, so let’s try to ease some of that potential confusion now.

Most consumers will find their touchpoint with the industry through dispensaries. These are the storefront retailers (although, online dispensaries are emerging) from which recreational and medical users can purchase cannabis. Some dispensaries are “Medical Only”, which means exactly what it sounds like, while others are a combination of both recreational and medical. Very few dispensaries are recreational - aka “Adult Use” - only.

And that’s probably for good reason. Combining both medical and recreational under one roof has proven to be the ideal strategy for margin maximization. The average dispensary sees profit margins from 15% - 21% while some of the most established in states like Colorado can see margins of over 30%.

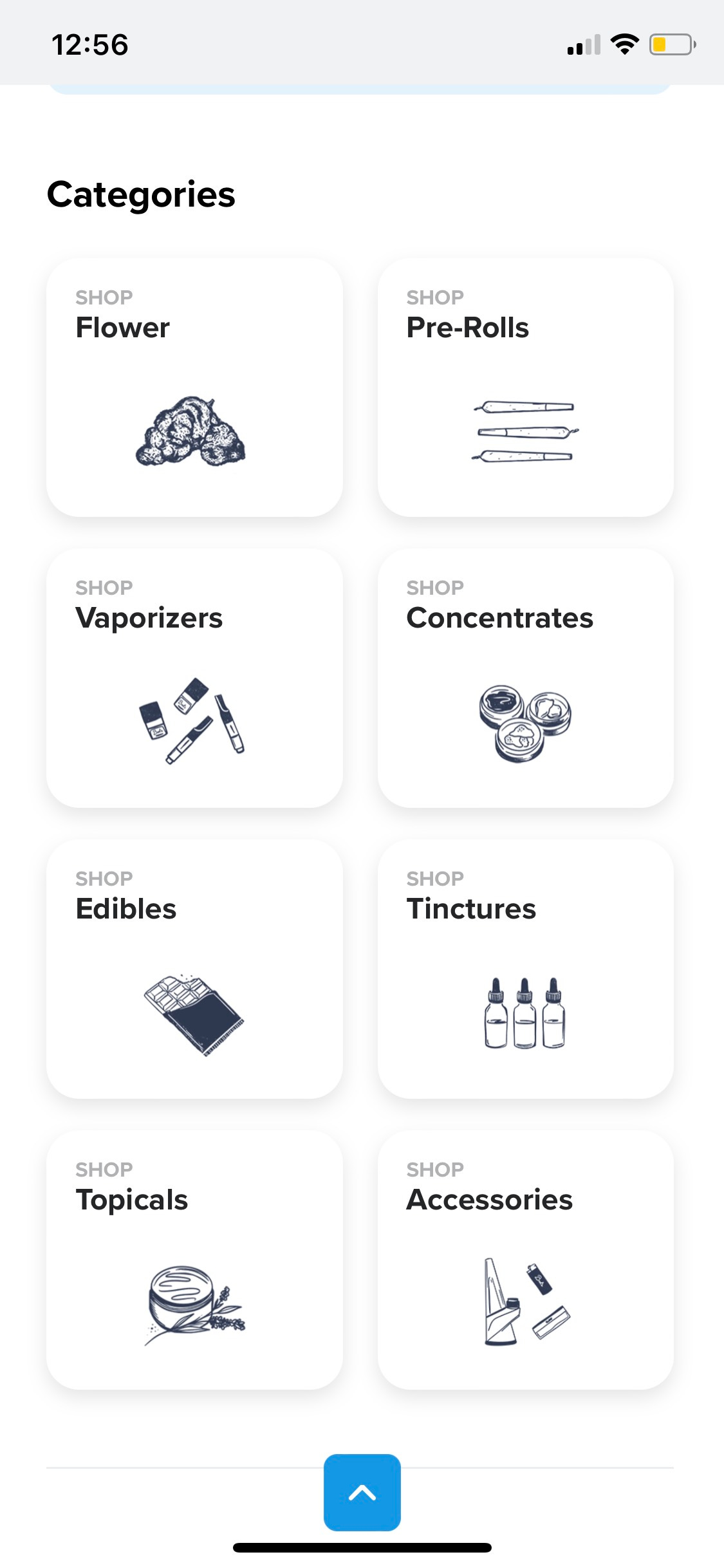

And most of these dispensaries regardless of their recreational or medical status follow a similar game plan. Typically, their menus will look a little like this:

See what I’m saying? Without knowing what those words mean, I’d probably just give up right there. We don’t want that to happen to you, so let’s give some definitions.

Flower: In cannabis, “flower” simply refers to the raw material that’s actually produced from cannabis plants. It’s the, well, flower on these plants, and although they’re not as colorful as roses or tulips, we promise they’re a lot more fun. You might also hear/see flower referred to as “bud” or “pot”, but they all mean the same thing.

Flower would fall under the “inhalation” category of cannabis ingestion. Once removed from the plant, the cannabis buds are trimmed and refined prior to being sold. From there, purchasers take the flower and grind it up into a smokeable, powder-like substance that can be rolled into a joint, smoked out of a pipe or bong, or really anything. It’s not hard to get creative with exactly how you want to smoke.

The key to a successful flower comes down to its strain. Strains, in cannabis, can be thought of as the type or even flavor of weed it is. However, the difference between strains doesn’t necessarily come down to taste or anything like that.

Broadly, strains can be broken into three categories; Sativa, Indica, and hybrid. Sativa strains elicit the classic “high” feeling of uplift, joy, and light-euphoria. Indica, on the other hand, induces feelings more along the lines of calm, relaxation, and sleepiness. Finally, hybrids seek to find a balance between the two. Most popular strains are some kind of hybrid.

Further segmentation reveals countless numbers of weirdly named strains like “Granddaddy Purp”, “Bubba Kush”, or “Peanut Butter Breath.” The main variations among these involve potency, as expressed by THC and TAC content, which are the psychoactive chemicals in cannabis that actually get you high.

The higher the percentage of those chemicals, the stronger the strain, with high-grade flower traditionally containing around 20-24% THC content. Cultivators have harnessed the power of genetic modification and complex breeding techniques to create some of the most potent and unique marijuana the world has ever seen.

While the element of balancing Sativa and Indica as well as optimizing potency isn’t specific to flower products only, it’s really the only way for this kind of cannabis product to differentiate. Differentiation is where pricing power is born, and while most flower hovers around the same price levels, strong branding for a solid strain can be a huge driver of success.

Pre-Rolls: Fortunately, this one doesn’t require as much explanation. Pre-rolls are flower-based products with the simple addition of prepackaging in a smokable joint form. One pre-roll looks like this:

Pre-rolls are simply flower that has previously been rolled for you. All the same dynamics that exist among flower carry over here as well, but they often charge a slight premium and drive higher margins. ‘Nuff said.

Vaporizers: Unlike the previous two, there is much more variation present in the vaporizers segment of the cannabis market. Now, this category still falls under “inhalation” and the substances actually inhaled are sourced from flower, however, there are a plethora of different ways to vape cannabis.

The key term to know here is “dab pen” or “wax pen” as they’re sometimes referred. These pens use vaporizer batteries to heat up a cartridge containing cannabis or hash oil so that it can be inhaled. Wax pens are often much more potent than flower products as they are formulated using extremely concentrated oil from cannabis flowers, containing massive amounts of THC, TAC, or even CBD.

A dab pen looks like this:

Vaporizer segments of dispensary menus include everything needed in the vaping process; from the cartridges containing the cannabis oil to the vaporizers themselves. These two elements can be sold separately with most cartridges having some degree of universality in the vaporizers they can work with, while others are sold as “disposable” pens, meaning the cartridge and vaporizer come attached and are not interchangeable.

These pens are some of the highest margins products at dispensaries. Because of their extremely high concentration, dispensaries can sell a relatively small amount of oil (typically 0.3g-1g) for quite a high price. Margins are much wider here than in flower, however, frequency of purchase would be lower as dab pens last a long time due to their potency.

Concentrates: Concentrates are essentially a combination of vaporizers and flower. The substance in question is a form of THC or another kind of cannabis oil, similar to that used in wax pens. However, it is consumed in a manner more akin to flower.

Essentially, users take the oily substance and place it in a glass or quartz “bowl” (the half-cylinder shape in the upper-left portion of the below image). The bowl is heated up to the point where smoke is produced, either through use of a lighter with the object shown below or electronically with more expensive “rigs.”

Here, the term “dab”, “dabs”, or “dab rig” comes up again as well. In general, “dabs” can be thought of as concentrated oil extracted from cannabis flowers. Like dab or wax pens, concentrates have extremely high amounts of THC and other psychoactive substances present in them, often upwards of 70-90%.

Because of this extremely high concentration and premium experience after use, concentrates too are much higher margin than flower. The downside here is that you gotta be a true cannabis connoisseur to get into concentrates. The rigs are expensive and so is the oil, but if you know what you’re doing, it can be worth it.

Edibles: Phew, the hard part is finally over. The rest of the product categories offered by most dispensaries, unlike the previous two sections, are relatively intuitive even to the most novice of weed users.

Put simply, edibles refer to any food or edible product that’s been infused with cannabis. Almost anything that contains fat can be made into an edible. That’s because THC and other cannabis compounds are fat-soluble, not necessarily water-soluble, and must be cooked into a fatty substance like butter to react with the human brain.

Chocolates, mints, and baked goods like cookies and brownies are common vehicles for edible consumption.

Unlike all the previous categories, edibles sold at dispensaries are often quite different from those sold on the black market (street dealers). Black market and homemade edibles can and usually do contain a helluva lot more cannabis than those sold in dispensaries due to regulatory limits.

But, this low dosage product is actually helpful with edibles. Most cannabis enthusiasts and frequent users err away from edibles, except of course for special occasions, due to their long-lasting effects and lack of immediate “hit.” On the other hand, edibles are the ideal and most frequently used way to get first-time users to try marijuana. Often, first-time customers have an aversion to smoking and, combined with the low dosage, will opt for a much more familiar delivery mechanism, like food.

This makes edibles typically the highest-margin products you can find in a dispensary. Like the others, branding is important but it is especially important in the world of food-based cannabis. If you can find a chocolate bar that not only tastes good but gives you that “high” feeling in the way you want, good luck convincing you to switch brands.

Tinctures: Edibles and tinctures kind of go hand-in-hand. While edibles refer to food-based cannabis products, tinctures include liquid or beverage-based cannabis products.

In cannabis, tinctures are ethanol-soaked and strained marijuana extracts in liquid form. They can be infused similarly to edibles into a myriad of different beverages. For that reason, tinctures too often find themselves in the hands of first-time users.

However, tinctures separate themselves from the rest in how often they are used in medical treatments, the kind actually prescribed by a doctor. These products are often marketed and sold as pain relievers, sleep enhancers, anxiety reducers, and much more.

Topicals: This one’s a little weird, not gonna lie.

Topicals, in the cannabis industry, refer to products like lotion that contain chemically active ingredients from cannabis. The difference here is that the cannabinoid receptors the marijuana interacts with are in the skin, not in the brain.

That means topicals too are often sold in the context of health care and well-being. CBD-based topicals have become especially popular, particularly in helping people with chronic, localized pain. As CBD is not psychoactive, even the most conservative consumers typically don’t mind or aren’t aware that cannabis is present.

Customers for these products are not the typical stoners you think of. More often than not, these will be sold to older customers with little to no experience using cannabis but that have tried other methods to help their pain relief to no great success.

Accessories: Last but never least, of course, are accessories. This one doesn’t require much explanation.

In cannabis, accessories include an almost infinite amount of products. Anything you can think of related to smoking, branding, merchandising and a whole lot more can be found here. Dispensaries have gotten wildly creative with their accessories. If you want some examples, just look here (not an endorsement, by the way, just the first dispensary I found when I Googled “Massachusetts dispensaries").

Great. Now let’s see how these products and their microeconomic profiles play out in the marketplace.

Market Dynamics

In its current state, the nature of investing in weed stocks is particularly precarious. I mean, keep in mind the product these firms sell remains illegal in the U.S. on the federal level. For most rational, sane people, that’s likely enough to dissuade investment for a long time.

But of course, I myself would never claim to be rational nor sane. There are a plethora of ways you could logically break down the cannabis industry, but the easiest first step is to once again bifurcate along geographic/regulatory lines. Let’s start in the U.S.

Market Dynamics of U.S. Multi-State Operators:

Competition: Right now, being a U.S. MSO is similar to being the New York Knicks - it’s really hard to get a win. MSOs are attempting to juggle one of the most competitive business landscapes possible while drowning in regulations, all in pursuit of some green.

If MSOs being at each other’s throats in every sense of the word isn’t enough, keep in mind these companies are also competing with the guys your state-issued D.A.R.E. officer warned you about. The black market or “street” cannabis markets remain a top competitor in 2022. But despite the strength of the street dealer right now, this is an early-stage issue set to decline right alongside the legal industry’s growth.

And that’s because there are only two reasons people would go to street dealers, being 1) prices are cheaper or 2) they are under 21 years old. We all know the youth will continue to find some way to get their hands on weed like they do alcohol, so that’s not much of a reason for concern. Price, on the other hand, is where things get hairy.

Pricing: In its own way, cannabis is already en route to becoming commoditized. Sure we’ll always have Indica vs Sativa and the infinite amount of different strains, but like how we separate gasoline by octane levels, cannabis will be a commodity in a similar way. That commoditization will give MSOs the economic scenario they need to compete with street dealers on price while remaining profitable. But, this commoditization likely won’t come until a massive regulatory change is undergone.

With transportation of marijuana across state lines remaining illegal, MSOs must maintain cultivation sites in each state they operate. This prevents uniform production for MSOs and is a threat to quality assurance of the product, meaning there remains wide variation in quality and consistency across states. That’s why you might hear someone say that Maine-weed is way better than Cali-weed, or something along those lines.

Inability to transport their product across state lines also prevents MSOs from achieving any meaningful scale for the time being. The goal for most of these firms has been to achieve state-by-state scale, hoping to one day consolidate across the entire nation following changes in regulation, but we’ll have to wait for that.

Sales Trends: Luckily, all of these aforementioned competitive dynamics hit every MSO relatively evenly. Differentiation among performance can, however, be seen through the lens of sales trends and industry consolidation.

Despite the rapid projected growth for the industry overall, certain markets have recently seen downtrends in sales. Markets like Colorado and Washington have seen slowed growth due to the loss of novelty held by cannabis products among the more mature customer base. Essentially, regular cannabis users have normalized their buying habits to lower quantities while non-regular users seem to have lost interest in giving weed a try.

This is completely normal. Like any industry, novelty of product can only propel sales for so long. Still, in a high-growth phase overall, certain parts of the industry are just a bit more mature than others. Keep in mind there are 31 states yet to legalize.

Moreover, 22% of young adults (aged 18-25) consume marijuana on a monthly basis while only 50% of U.S. adults report that they’ve even tried cannabis. To say the least, there’s plenty of room to run.

And for MSOs, customers appear to be running in the right direction. Popularity of edibles has soared in comparison to other products, with every generational group reporting these products as their preferred way to ingest cannabis, except Gen Z, who said vapes were the way to do it. Given the solid margin profile of edible products along with their ability to attract new users and construct a brand, dispensaries and MSOs alike want to see this trend continue.

M&A: And lastly, the final dynamic to be all too aware of before diving into trading MSOs is industry consolidation.

As we said, achieving scale is crucial to MSO success. That’s been hard under a state-by-state governance regime, but following in the footsteps of other industries, cannabis has begun this process with widespread M&A.

In 2021, dealmaking spiked nearly 2x among MSOs. This is a sign of maturation in the industry as prior to the pandemic, MSOs primarily expanded via a “land and grab” methodology to acquire licenses in as many states as they could. Now, expansion has begun to come through mergers and acquisitions.

Assisting in that trend is the fact that these transactions are no longer as ridiculously speculative as they once were. Firms with more mature business lines, such as Trulieve or Green Thumb Industries, have started to generate positive EBITDA, net income, and cash flows.

Still, consolidation only gets harder from here. It appears that the states are doing whatever they can to impose fragmentation on the industry, particularly by limiting the number of stores and other operational sites any firm is allowed to have within the state’s jurisdiction. While sometimes companies are able to work with regulators to bypass this, that is the exception and not the norm.

Market Dynamics of Canadian LPs:

Now, up in Canada, things are mostly the same, only different. National legalization has been a boon to the industry for the past few years, allowing both firms and markets to mature moreso than in the U.S.

With that said, a lot of the same dynamics that exist in the U.S. are present too in Canada. From the perspective of pricing, competition with the black market, and M&A, pretty much everything in the U.S. holds up north of the border. As a result, this section requires less explanation.

Growth: In short, growth has been massive in the Canadian cannabis market. The nation’s legal weed market posted aggregate sales of ~CA$150M in sales in 2018 followed by ~CA$1.2B in 2019 all the way to ~CA$4B in 2021. That’s a 3-year CAGR of nearly 200%, a rate even industries like cloud computing are envious of.

Obviously, however, that won’t last. In fact, similar to MSOs, sales growth has slowed dramatically. Cannabis research firm BDSA estimates the 2025 total market sales will be ~CA$6B. While this growth certainly isn’t anything to scoff at, it’s important to recognize the slowdown.

But although industry sales are expanding, companies themselves are having a tough time registering that growth. In 2018, 150 companies were licensed producers. Now, there are well over 800. Clearly, demand is strong, but the challenges for these companies come in the ruthless competition to be the supplier of choice.

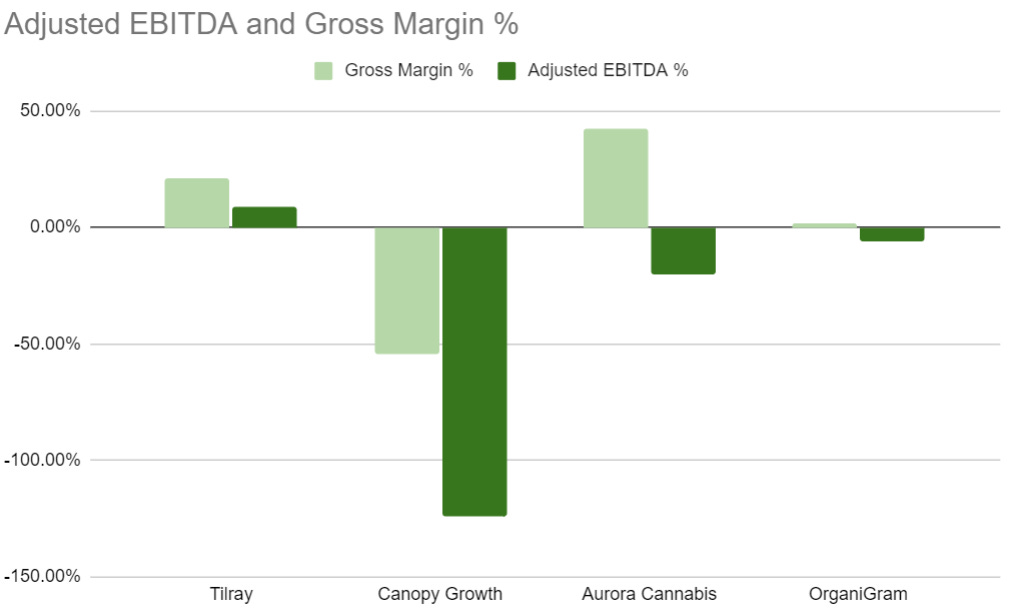

Profitability: You might think that given their ability to achieve national economics of scale, LPs must have an easier path to profitability than MSOs. Nope.

As you can see, even posting a positive EBITDA has been a near-impossible task for these firms. Much of that comes from write-downs in asset valuations, but the overall trend is that competition has been so intense, particularly on pricing, that firms are essentially competing each other’s profits to zero.

As consolidation continues like with U.S. MSOs, driving a profit will become a slightly less impossible task.

To finish off this section, let’s generalize both markets and the competitive landscapes in which they operate. To do so, we’ll use everyone’s favorite framework that you learned back in Business 101.

Cannabis Market: Porter’s 5 Forces

Threat of New Entrants: HIGH —> Cannabis is a young, dynamic, and versatile industry ripe for new competitors. The product literally just became legal in the past decade, and as a result, new entrants have been and continue to quickly emerge on the scene.

Threat of Substitutes: MEDIUM—> Switching costs are low and the only market-wide differentiation now in existence comes from price. As brands grow, some will entrench themselves and become, like, the Coca-Cola of cannabis, thus reducing risk of substitution. But for now, unless your strain has caught on with a sizable customer base, you better watch out.

Customer Bargaining Power: HIGH —> Similar to the above, low switching costs make this an easy one. Customers run this market. The number of end consumers is of course incredibly high, which generally suggests low bargaining power, but in an industry where it’s all about price and trying things for the first time, customers are in charge.

Supplier Bargaining Power: LOW —> On the other hand, suppliers do not have a huge amount of influence on the market. Most players in both Canada and the U.S. have been steadfast in pursuing vertical integration. Lending itself to such dynamics, most suppliers and sellers will be under a common roof.

Rivalry Among Competitors: HIGH —> Do I even need to explain this one?

Congratulations! As far as we’re concerned, you’re now fully equipped to make intelligent investing decisions within the cannabis market. But that’s all for today, folks. Again, stay tuned next week for stock picks, price targets, and much more.

If you like our stuff, remember to comment, share, or reach out to us with any kind of feedback! Find me at markets.aurelius121@gmail.com. Cheers!