***this piece turned out ridiculously long, so if you don’t care to dive as deep as we did, check out the TLDR at the very end that sums things up in a ~5min read. thanks!***

Every generation has its quirks.

Some, like the Lost Generation, find their quirks in things like fighting two world wars by the time they were 40. Others, like the millennials, are quirky in their apparently crippling fear of buying homes. Gen Z, on the other hand, is quirky in pretty much every sense of the word, and their investing habits are no exception.

But you probably already knew that. I mean, there’s a reason the whole $GME dumpster fire occurred right when the older Zoomer crowd was turning 16-24ish. Hindsight has given market watchers an understanding that there’s certainly something strange about where Gen Z wants to put its money, but what exactly that is, we don’t know…yet.

To shed those loose preconceptions of Gen Z investors, we went straight to the horse’s mouth. As I sit in the final few weeks of being able to call myself a college student, I figured I’ll put my youth to use and employ our fellow Gen Z classmates as guinea pigs to get a read of exactly how Zoomers invest.

But first, some definitions. Generation Z, aka “Zoomers”, “the iGen”, or “centennials”, are commonly classified as individuals born anytime from 1996 to 2012. Gen Z is currently the largest generation on planet Earth, comprising around 30% of the global population while also exhibiting the most diversity across its members. We were born alongside the infancy of the internet, communicate primarily through digital means, and have had smartphones and Snapchat since we were 12. The “cyborg generation” seems like an equally fitting nickname as any of the above, and being the first people to have advanced technology before even hitting puberty, our whole generation is essentially guinea pigs for the digital revolution.

And that’s made our personalities, outlook, and brains themselves different from any previous group of humans. As I said, our investing style is no exception.

Now that I’ve delayed and obfuscated enough, let’s dive in. We issued a 15-question survey to two university investment groups, amassing 103 responses in total and a whole lot of insights. Yes, it’s a survey, so keep in mind all the caveats that go along with that (as we know, this form of data collection is far from perfect), but hey, what else are we gonna do?

Insights

Actually, I lied - we do have to delay and obfuscate a little more.

Yes, Gen Zers were born between 1996-2012, but as of today, that makes you somewhere in the range of 10-26 years old. And within that range, we’ve got a lot of variety, all the way from an almost-billionaire (shoutout Kylie Jenner) to the kids in my mom’s 5th-grade class who clean their shoes with hand sanitizer.

So naturally, we couldn’t survey all of Gen Z. I mean, only those of us born before mid-2004 can self-custody a brokerage account anyway. But still. This is a massive generation with vastly different ideals and motives than any previous, so it certainly helps to be ahead of the curve on just how this cohort wants to invest. After all, you Xers and Boomers out there will be selling assets to us soon!

Last thing (I promise this time). Every respondent to this survey is a member of a college-level, student-run, real-money, investment group. Obviously, this implies that our respondents are likely (definitely) more knowledgeable on investing than the average Gen Zer. But then again, they’re in college, so while they might be above average for their age, they’re far from experts. As I said and will keep saying, it’s not at all perfect, but it’s better than nothing.

Actual Start of Insights

How do Zoomers Access Markets?

Let’s start simple. You all know there are basically infinite ways to be able to call something “investing” or consider yourself an “investor.” For our purposes here, we kept it uber simple.

First and foremost, ~88.3% of respondents (91 people) answered “yes” when asked “Do you have at least one investment account?” - nice, we’re off to a good start. Unfortunately for them, the 12 respondents who answered “no” ended the survey here. Sorry, but get in the game, or literally no one cares.

So among Zoomers familiar with investing, almost 9 in 10 actually put their money at play. That’s a pretty risk-on group of people, and we’re loving it.

Otherwise, there was nothing exactly groundbreaking in this section. Almost 85% have at least a brokerage account, while 28% have some kind of IRA. The vast majority of that cohort, 23% of the 91 respondents, have Roth IRAs, which is not only shockingly high but shockingly smart as for almost everyone earning a MAGI of less than $144,000/yr, this is the correct decision.

Lastly, there are a helluva lot of crypto bros out there. Consider this a foreshadowing for what’s to come, but your preconceptions were right - Gen Z loves crypto.

And this became blatantly clear when asked “What platform(s) do you use to invest?”. On this one, the guy making the survey dropped the ball. Whoever that was must be a real moron, but basically, all this did was result in a ton of responses in the “Other” category. Thankfully they could write in their own answers, so it wasn’t a total loss.

Disgustingly, 46.2% of respondents use the cesspool that is Robinhood as their on-ramp to markets. Guess we know why Robinhood’s median account balance is a whole $240 - it seems like this is the undergrad platform, then once investors have real money, they take their cap and gown to an actual investment service.

Here’s where the smart, cool Gen Z investors take the stage. A solid 26% of respondents use Fidelity. Considering Fido is basically a utility service for retirement accounts, I think we know where that’s coming from. E*Trade and TD were neck and neck around 18%, while 0% of respondents use “popular” platforms Acorns and Interactive Brokers. More niche platforms like Webull, SoFi, and tastyworks (shoutout Strat), got the checkmark from roughly 10% of respondents.

But like I said, the idiot running the survey left out some blatantly obvious ones. For example, plenty of respondents use Schwab. Interestingly, one person wrote in “Fundrise” (crowd-owned R.E. platform), while a TON of respondents wrote some variation of the term “crypto” or “crypto platforms.” Again, this’ll be a common theme today as we uncover Gen Z’s investment habits, styles, and goals.

Speaking of which…

What are Gen Z’s investment goals?

In case the whole “risk-on” thing wasn’t entirely getting through to you yet, just wait. Here’s where the fun begins.

Goals drive everything. A good investment for me might be a terrible investment for you - and looking at my performance throughout 2022, all of my investments are terrible for you. But that’s beside the point. Anyone can argue that a certain stock is the next Amazon and therefore you should own it. But if my goal with that money is to protect it against inflation so I can buy a house in 5-years, putting that cash in any single stock or fund is a horrific idea. Duration is the primary consideration in assessing your goals and purpose for investing, and given Gen Z’s bountiful youth, we’re going to be putting money away for a while.

I doubt they’re aware of it based on other responses we’ll discuss later, but the iGen of investors is investing spot-on for the long haul. We asked Zoomers to select their top two investment goals, and among the slew of options presented, the top 3 responses include:

“To build a sizable nest egg for the future” (79.5%)

“To learn about investing through actually doing it” (59%)

“To speculate in hopes of finding the next $GME” (28.2%)

Yup, sounds about right.

While it’s great to see the youngens are predominantly focused on building economic security for the long term, I’m sure no one is surprised at that 3rd-place option. On its face that might be concerning as it could suggest we’re all just degenerate speculators (again, shoutout Strat), but from another perspective, this is exactly what we want to see.

Jesse Livermore said speculation is as old as the hills, and he was exactly right. In all reality, speculation will almost definitely continue to exist for as long as those hills. It’s human nature, so we’re never going to avoid it, but young people are exactly who should be taking on that role of degenerate speculation. We as a society will be much better off if we continue to let people like me and my peers take big, senseless bets in hopes of a huge payoff. We’d much rather have 23-year-olds blowing up their $5,000 AUM than Gerry Boomer destroying his estate when he turns 80.

Society benefits if investors get that gambling itch out of their system as soon as possible. And sure, you can say the whole point is to teach people not to speculate in this way, but I’d argue that this itch is as rooted in evolutionary biology as anxiety or other undesirable necessities. We can’t avoid human nature, but we can optimize the collective outlet of our Animal Spirits. Letting kids blow themselves up early (with the caveat that they learn from these experiences) is the way to go.

But even still, Gen Z claims to be laser-focused on the long haul. If that’s true, let’s find out exactly who their role models are in getting to financial security.

Who Are Gen Z’s Investing Role Models?

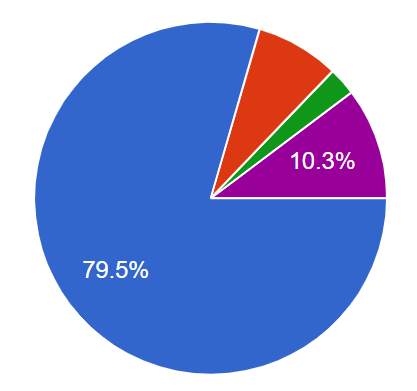

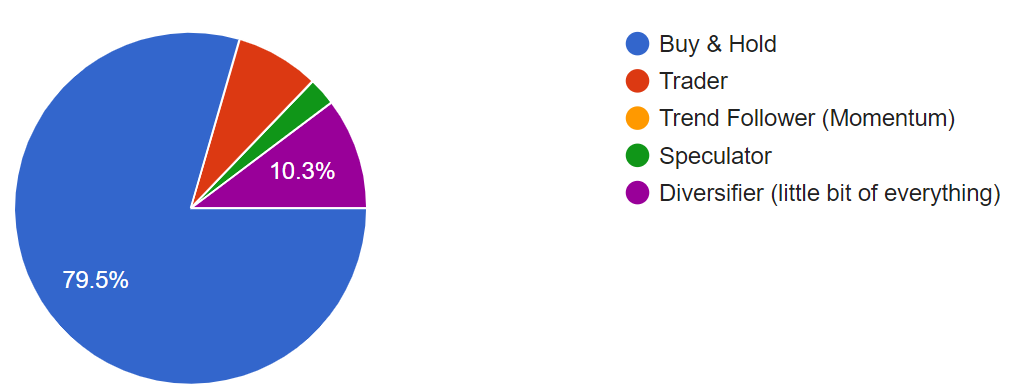

One of the more interesting responses came when we asked respondents to self-identify their investing style, allowing just one response for this one. Take a look at this pie chart below for the question “Which of the following best describes your investing style?”

Among the options of “Trader”, “Buy-and-Hold”, “Trend Follower (Momentum)”, “Speculator”, and “Diversifier (little bit of everything”, I’ll give you one guess as to what that blue slice is.

That’s right, add another W to the “Buy-and-Hold” column because ol’ reliable is still by far the most in vogue. And because I know you’re dying to see it now, here’s the full breakdown:

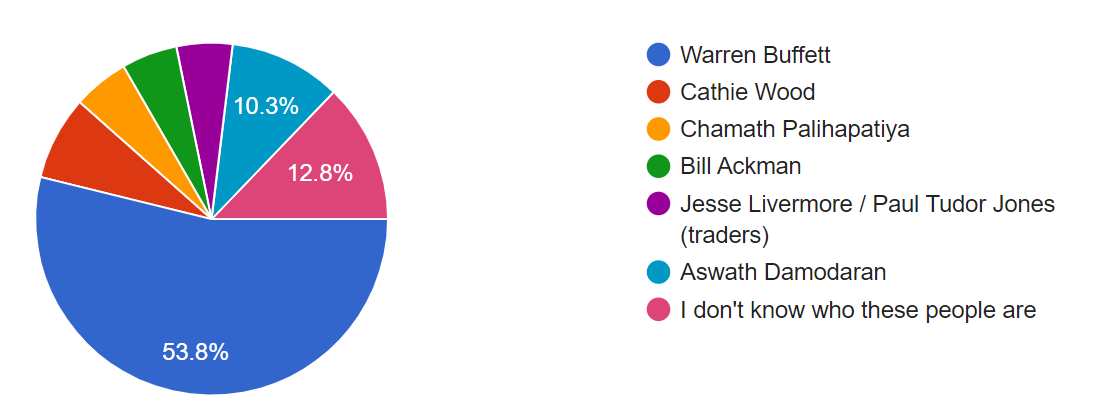

Like what we discussed in our last section, this seems healthy. Things get interesting when we look at this paired with the next question “Which of the following investors does your investment style most align with?”

No guessing on this one because obviously, Buffett’s gonna be the top dawg (as always). What’s interesting is the number of people who have no idea who he or any of these other Wall-Street-household names are.

79.5% identify as buy-and-hold investors, but only 53.8% of finance students selected him as the investor they most seek to emulate. Sure, some of the other options like Aswath or Bill could’ve taken up some of these responses, but pragmatically, anyone that chose “Buy-and-Hold” would be expected to choose “Warren Buffett” - the king of buy-and-hold - as their investing role model.

Do they just not know who he is? Is that possible? Personally, I say a prayer or two to the Oracle every night, but wow, I did not at all expect the 2nd-most popular response to this question to be “I don’t know who these people are.”

Okay, so Gen Z might not know who these people are or exactly what they’re doing, but they sure seem confident in their decisions. Let’s finally find out exactly where Gen Z is parking their hardly-earned cash.

To What Industries & Asset Classes Does Gen Z Have Exposure?

This one can be summed up pretty quick through the statement “the higher the odds are that an investment goes to 0, the more Gen Z wants it.”

Or maybe “the higher the odds that this investment grows 100x by the time I’m 40” is a better summation. Either way, the sentiment is basically the same.

Before even asking where Zoomers park their cash, we thought it would be fun to find out what Gen Z regards as the most important factor when considering an investment in an individual company. Shoutout to the Gen Xers and above on this one - you clearly taught us well - because according to the iGen, “Strong Fundamentals (free cash-flow growth, healthy balance sheet, etc.)” was the gold medalist, and it wasn’t even close.

Second place went to Strong Fundamentals 2.0, this time qualified by “sales growth, margin expansion, etc.” Bifurcating across the former, a more advanced perspective on fundamental analysis, and the latter, a more simplistic fundamental take, gives us an idea of how Gen Z goes about understanding a company’s financials. While it’s surprising to see that free cash-flow growth was given more importance than sales growth, I’m sure we’re all just glad to hear that Fundamentals wasn’t last.

The answers that did place last, however, might come as a shock. Three answers received just one vote, those being “Large TAM”, “Innovation”, and “Macro Trend.” Evidently, I’m not very self-aware as I assumed these would be the top 3 answers, not the exact opposite. Maybe Gen Z takes investing a little bit more seriously than we tend to think.

Of those who indicated that they did have an investment account, 13% hold absolutely no individual equity exposure. While with the data we have we can’t really tell if that 13% is BTC maxis or Jack Bogle disciples, we can assume there’s some kind of breakdown between the two camps. If only the guy writing this didn’t screw up the survey so bad…

Anyway, we have a lot more to talk about, so let’s get straight to it. Fast facts incoming:

87% have exposure to “Individual Equities”

36% have exposure to “Cryptocurrencies”

21% have exposure to “Options / Derivatives”

18% have exposure to “Real Estate (REITs)”

8% have exposure to “NFTs”

7% have exposure to “Fixed Income”

1 respondent has exposure to “Real Estate (Physical Property(ies))”

Okay, that’s a lot. I think the best / funniest takeaway here is the fact that more Zoomers have exposure to an asset class that no one had ever heard of before the pandemic, NFTs, than have exposure to the $119tn global fixed income market.

And that’s as it should be. NFTs are cool, fun, and new, and yeah they might be 99.99% worthless, but we’re young enough to afford such stupidity. Outside of needing that money within the next few years, why should any sub-22-year-old even think about buying a bond?

I really thought I might have to tell Gen Z to take on more risk here, but they’re way ahead of me. A combined 57% have exposure to some combination of derivatives or crypto, so looks like we have that covered. I’m honestly surprised that only 36% of Zoomers hold crypto, but this could suggest a split between traditional finance and decentralized finance investors. Perhaps there is some credence to the idea that a lot of Gen Z investors have planted their flag in either the crypto or TradFi camp with minimal overlap.

And it’s within that crypto exposure that we find what I consider the most shocking result of the entire survey. Given the options of Bitcoin, Ethereum, DeFi Coins, Metaverse Coins, Stablecoins, and Other Altcoins, we asked “If you invest in cryptocurrency, which of these options do you currently hold?.” Roughly 2/3rd of respondents checked that they hold Bitcoin, but surprisingly, nearly 73% of respondents indicated that they hold Ethereum.

Among Gen Z investors knowledgeable of the investing landscape, Ethereum is a more popular asset than Bitcoin. Let that sink in.

Sure, they’re both crashing this week (what else is new), but the fact that more young investors are excited by ETH than BTC goes against everything I and most market watchers would’ve assumed. When we talk to civilians about the world of investing, it’s almost expected to mention BTC at some point, but I’d guess at least 95% of them have no clue what ETH is. Given that ETH actually has utility as opposed to BTC’s quest to replace gold, I consider this hyper-bullish for the industry. Identifying the utility from the noise is a tall task, but Gen Z seems pretty adept at this already. That’s not to imply BTC is just noise, but just to highlight that iGen investors prioritize purpose and potential utilization over the perfectly immutable financial system that is BTC. Flippening incoming.

From this section, the rest of our takeaways are rather underwhelming. We asked respondents to tell us what industries they have the most exposure to, and the responses were exactly what you’d expect.

For 67% of respondents, “Technology” is their most highly-concentrated industry. Next up is “Financials” (21%) followed by “Consumer Discretionary” then “Consumer Staples”. Notice anything? Gen Z investors love putting dollars into the companies that they know and interact with from a consumer perspective. That suggests a highly Peter Lynch-ian cohort of investors; one that loves to invest in companies they use or admire.

But we knew this already, so nothing groundbreaking for me to absentmindedly opine on. In the final questions of the survey, we sought to gauge the role investing plays in the lives of Gen Z investors. Considering most aren’t yet DCA-ing into Roths yet, we went at this a little differently…

Is Investing Cool?

(as I typed that header above I realized that would’ve been a super cool question to ask too, but maybe next time)

It’s common knowledge that young people will do just about anything if their friends are doing it. Again, we can thank human nature here. We wanted to get at least some sense of how Gen Z and their social groups think about investing, and like the other responses, these did not disappoint.

First, we asked, “Do you talk about investing with your friends?.” An initially surprising 100% of the 91 respondents indicated “Yes”, they do talk about investing with their friends. I say initially surprising because it’s crucial that we remember the people in the sample we’re working with here. All of the respondents presumably want to work in finance / investing, and I don’t know any friend groups that don’t talk about their professions.

But the next question, “If so, how often do you talk about investing with your friends?”, gave us an interesting answer. 0% of respondents indicated “Never” (obviously, after that previous question). However, the most popular choice was “Fairly Often (a few times per week)” at 36% followed by “Somewhat Often (at least once per week) at 31%.

The weird thing here was the sheer amount of nerds apparently present in the investment groups that we surveyed. On that same question as the above paragraph, 21% of respondents indicated that investing “[is] our primary topic of conversation.”

Listen, I get that we surveyed kids hyper-focused on landing careers in investing, but c’mon. I don’t even think Strat and I would put investing as our main topic of conversation, and we’re the two biggest finance losers (and regular losers) I know. Gen Z either loves investing a little too much or perhaps was feeling a little enthusiastic while taking the survey.

Now to put that enthusiasm to use, we capped off the survey with an entirely open-ended chance for respondents to “Tell us one thing you believe to be unique to your investing style or habits (can be literally anything - get creative!).” Gotta end it on a fun note, right?

Thankfully, respondents were feeling pretty creative. Some went full-meme with it (or just plain psychotic) saying things like “I am better than Warren Buffett” and “My strategy is buy high sell low 😤. ” But of course, we’re here for the memes. All else I can say is good luck with that one, brother.

Others, however, demonstrated their creativity in a less headache-inducing way. Some go hard with it, explaining that “I'm a sleuth. I specifically try to visit locations in person, talk with clients of the business I'm researching and get to have conversations with management.” Sound like anyone that writes for this publication?

But the remainder of the responses were all pretty similar. Almost every respondent mentioned something about considering a balance of duration, fundamentals, bet sizing, macro awareness, and looking for stones others haven’t yet turned over.

Now that we’ve developed an understanding of Gen Z’s collective investing style, it might help to formulate some potential takeaways. So, what did we learn?

TLDR: Key Takeaways

15 questions, 103 respondents, a ton of data, and even more takeaways - that’s what we’re running with today. In case you didn’t have time to read that novel above, here’s the synthesis and key takeaways to be aware of from our first-ever DYD survey.

Gen Z Loves Risk

If real estate is all about location, Gen Z investing is all about duration. The respondents in this survey all are active participants in investment groups on college campuses, so we can assume they know a bit more than your average Gen Zer. Still, it’s great to see that most of Gen Z is aware of their youth and willing to take on a high degree of risk for a potential payoff way down the line.

No disrespect to our Zoomer passive investors, but right now is the time to take big bets in the things you believe in, if that’s something you might ever want to do. As a purpose-driven, free-flowing, and diverse generation, it seems these sentiments carry over into investors’ risk appetites.

More than half of Gen Z investors have exposure to assets of the utmost risk, being derivatives and cryptocurrencies. Although a marginal difference, more Zoomers hold NFTs than fixed income securities. Nearly 90% of respondents who do invest hold individual securities, and when given the chance to tell us anything about their investing style, most Zoomers mentioned something about sticking around for the long run.

Not exactly the kind of investments you’d advise your grandmother to make, but for Gen Z, this is exactly what we want and need.

Gen Z is (somewhat) Smart About Those Risks

As hinted at above, the iGen investors are well aware of their risk-on nature.

While being cognizant of the risks they’re taking, Gen Z seems to deserve a little more credit than they often receive in investment analysis. Fundamentals absolutely dominated when asked what the most important factor is when buying an individual company. And not just easy fundamentals like sales growth and margin expansion; Gen Z demands growing free cash-flow generation and smart capital structures.

Momentum strategies were popular too, but were almost not worth mentioning in comparison. Stories ranked next in importance, with more than 10% of respondents indicating that a compelling narrative is a key factor in driving investment decisions.

Within their cryptocurrency holdings, however, Gen Z is here for the utility. Ethereum is a more popularly held asset than Bitcoin among this generation (flippening confirmed) and respondents flocked to add “crypto platforms” in the “Other” category when asked what services the respondents use to invest.

Within equities, technology was by far the favorite industry these investors have exposure to. Financials and Consumer names followed, suggesting Zoomers love to invest in the Lynch-ian way of buying companies you know from a consumer perspective.

Despite this apparent awareness of their de facto risk profile, Zoomers aren’t too familiar with those that paved the way before them. When presented a list of Wall-Street-household names and asked to select which of these they aligned most with, Zoomers overwhelmingly chose Buffett first. The surprise came in the second most popular response, being “I don’t know who these people are.” I guess Cathie Wood and Bill Ackman aren’t as popular as they might think.

Investing Is Kinda Cool

The nerds win again.

Traditionally, investing has been thought of as a boring game meant for rich old men and scumbag scam artists. No more, says Gen Z, indicating that discussing markets and our roles within them is a regularly common occurrence within social groups.

Almost 21% of respondents claimed that investing is their primary topic of conversation with friends. The only responses more common included both fairly often and somewhat often, but still, the fact that this is being talked about to such a high degree says something about the growing role of investments in our daily lives.

Platforms like Robinhood have certainly had a hand in this. And despite being a bumbling band of bullsh*tters, Robinhood is still by far the most favorable investing platform among the market’s youth. Having access to your investment portfolio as easy as logging onto social media is a powerful dynamic and one whose impact won’t be going away anytime soon, with or without another $GME fiasco.

So there you have it. Gen Z loves risk as a route to achieving their long term goals, is pursuing those goals in at least a mildly intelligent way, and is bringing their friends along with them. I’d say so far so good, things seems to be going well for the current generation of investors, even if today’s market isn’t helping them out with that at all.

Now if we could only get them to stop using Robinhood…

- Markets Aurelius