The Truth About Truth Social

When the best case scenario is the merger not being approved

Digital World Acquisition (Nasdaq: DWAC - $1.17 billion) is a blank check company that is attempting to take Trump Media & Technology Group (implied value of $8.64 billion) public. Trump Media & Technology Group is a media startup that has launched a social media app, Truth Social. The company also has plans to launch a streaming service, TMTG+. It also has critical flaws that limit its addressable market, gives low potential monetization of users, and require extensive capital requirements that the company cannot meet despite its $1 billion PIPE.

These issues lead me to believe that if a merger is completed between DWAC and TMTG, which could not happen as highlighted in a great report by Kerrisdale Capital last week, the company will quickly run through its cash balance and be forced to massively dilute shareholders to stave off insolvency. I should note that this analysis will not touch on topics covered extensively by Kerrisdale last week, I encourage you to read that report for the valid concerns listed. I will only cover an analysis of the odds that the business succeeds (or fails), and why I have such beliefs.

In my opinion, the best-case scenario for shareholders is the merger being called off and the stock falling 75% to $10. If the merger is completed as is the base case for this report, I see over 95% downside from the most recent closing price of $41.

TMTG+ Disaster

While Truth Social is already available for download and floundering, I’m going to talk about TMTG’s planned streaming service first since the company’s SPAC presentation claims this will be over 90% of the company’s revenue by 2026, and the majority of revenue every year once it begins operations.

The company claims that by 2026 its streaming service will have 40 million subscribers. This is almost equal to Disney+’s current US subscriber count, and likely over half of Netflix’s US subscriber base. Such a lofty aspiration is not only claimed to occur within 5 years but also with far less capital to achieve its objectives while having to build its entire content library independently.

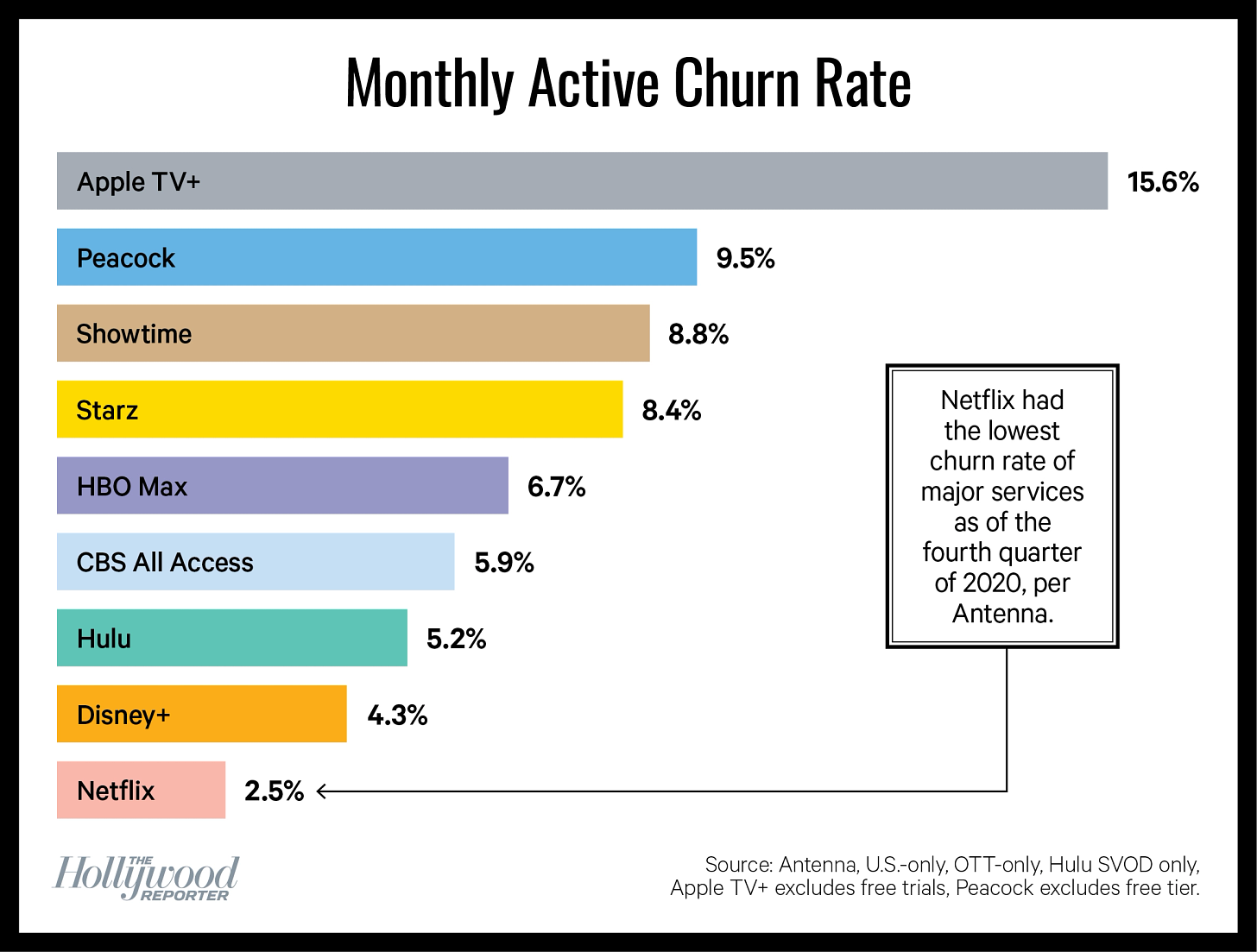

This is unrealistic for two reasons. The first is the state of the streaming industry. Streaming has become saturated with competition and commoditized as a service. It’s a capital-intensive market (almost 75% of Netflix’s 2021 opex was on content creation) as there’s a continual need to ramp content spending to retain users, yet with no moat to create any stickiness among the customer base.

There are no switching costs for the consumer, and you only need to temporarily subscribe if there’s a “must-watch” show. This is part of the reason why virtually all streaming businesses that are not either mature or had a pre-existing strong IP base tend to have an annual churn rate of almost 50%.

These issues are compounded for the proposed TMTG+ streaming service. To make an entire catalog of original content as the company plans to do will be extremely capital intensive and materially past the liquidity available to the business from the SPAC merger (assumption in this writing is a scenario where the merger happens). Without a wide content library and original IP, as well as the lack of traction from the Truth Social app, it’s likely that churn would also be high, possibly more than 50% annually if above Hulu’s rate, which I presume to be likely.

Because of these problems, I view the company’s expectation of reaching $9 per month as an average revenue per user as wholly unrealistic. The company’s lack of an ability to scale its original app, lack of capital, and lack of content means its pricing power will be non-existent. Currently, I view the company being able to generate $3.25 per month per user as a fortunate scenario.

I also view its projected 40 million users by 2026 as equally unlikely. Reaching 7.5 million users by the same period is a far more likely outcome considering the operational difficulties in achieving scale and high competition within the industry, which does include non-streaming platforms like YouTube, Rumble, Spotify, and more.

These factors lead me to believe that the company will be generating close to $200 million in streaming revenue by 2026 compared to their presentation estimates of over $3 billion. This is a dramatic difference, but considering the company’s current form is almost that of a shell business I have a strong degree of confidence in making this assumption: TMTG+ will fail.

Truth Social Flop

From the departures of key people in Truth Social’s operations, security failures, and Trump reportedly having considered leaving the company for Gettr, it’s apparent that the launch of Truth Social has been a flop. However, I don’t want to just look at the qualitative failures and crumbling download numbers that are well established but analyze with the information available to me the viability of Truth Social as a profitable platform in the future. It doesn’t look good from what I’ve found.

Firstly, the addressable market of Truth Social is far smaller than people would assume. The company markets itself as a “Big Tent” alternative. This messaging at the surface would make someone believe that the potential reach of the app is larger than existing applications. However, the reality is that the “Big Tent” message is, and has been, a myth.

As has been seen with each iteration of a new social platform that markets itself as “censor-free” and “big-tent” like Parler and Gettr, the result is actually the formation of an echo chamber of very like-minded individuals. Not only does this limit the reach of an app like Truth Social by discouraging many potential users from downloading the app, it likely harms engagement too. People seeing things they just agree with will be less likely to start a conversation, driving down engagement compared to peers and making the platform less viable for advertisers.

There’s another problem in monetization too, that being risk association.

the process whereby an agent establishes a connection between something, x, and the notion of risk. In addition, risk association can be defined as the result of such a process, i.e. an established connection between x and risk. (Max Boholm)

In the case of advertisers, this would manifest itself in a company not placing ads somewhere because of the risk association of a brand being placed next to dangerous/insensitive/harmful content leading to the potential loss of sales, as well as potential reputation damage. This has happened in the social media industry before, most prominently in YouTube’s apocalypse, and has become a unique problem for “censor-free” platforms.

The problem is that “censor-free” platforms tend to have weak moderation to remove content that is hateful and potentially damaging. Weak moderation increases risk association for brands, lowering their propensity to place ads on a platform, thus lowering the CPM rates such an app can charge as aggregate demand is less.

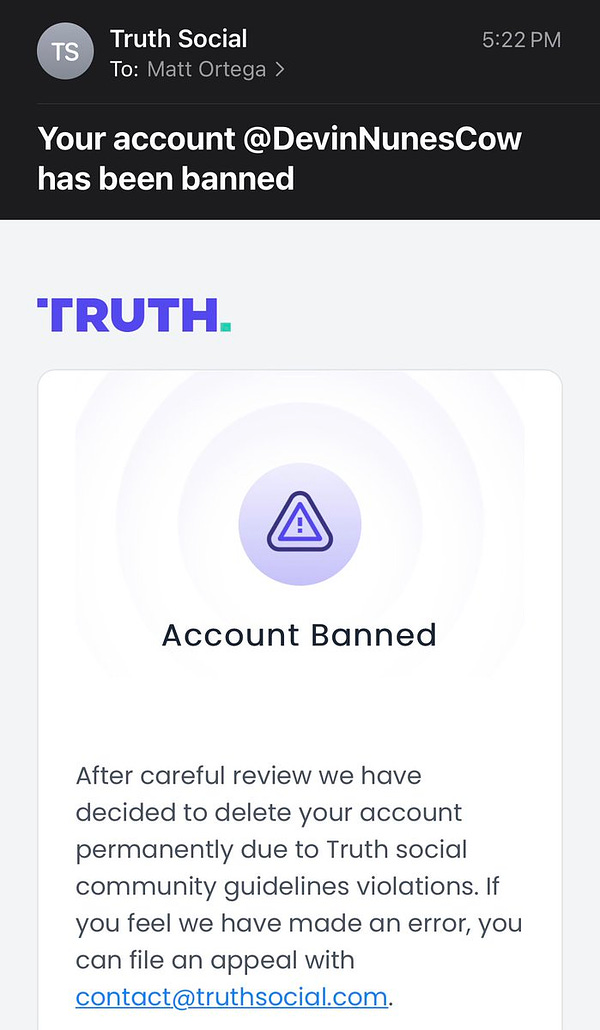

While Truth Social is willing to censor and ban people for having account names that make fun of the company’s CEO (who also has no relevant experience in running a tech company), the app does have the same problem with a lack of moderation.

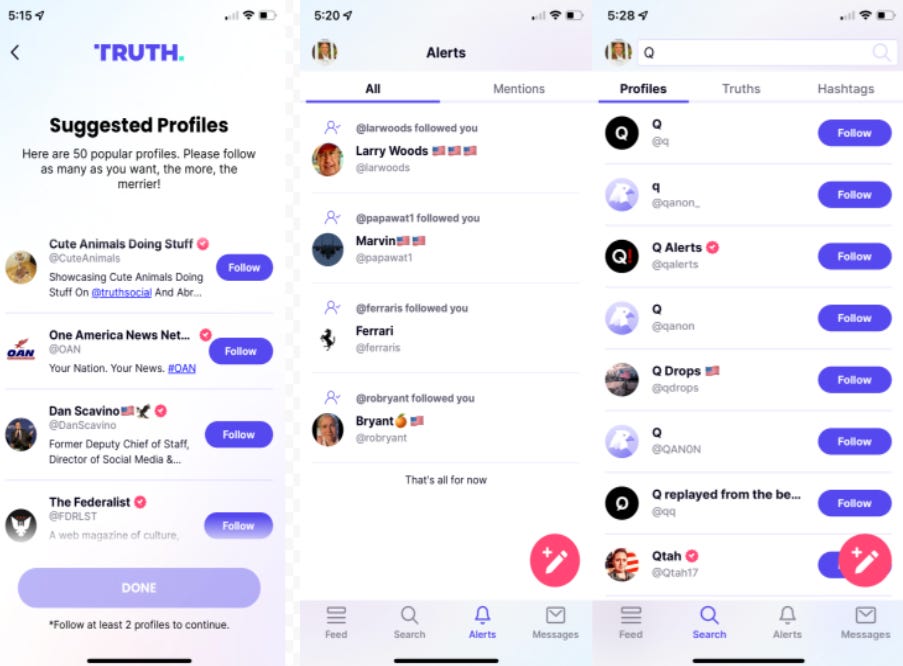

This is exemplified by its signup algorithm suggesting new users follow accounts that advertisers would face risk association with. I just got off the waitlist in time for this publication, so I can share some immediate problems I’ve seen.

I was prompted to follow several conspiracy outlets such as OAN, Newsmax, and others

Immediately after making my profile I’ve been followed by several bot accounts (now at 8 and counting)

There is no native discovery on your feed, you can only see posts from accounts you already follow

What’s worse is the app’s algorithm, which promotes unconscionable items and topics.

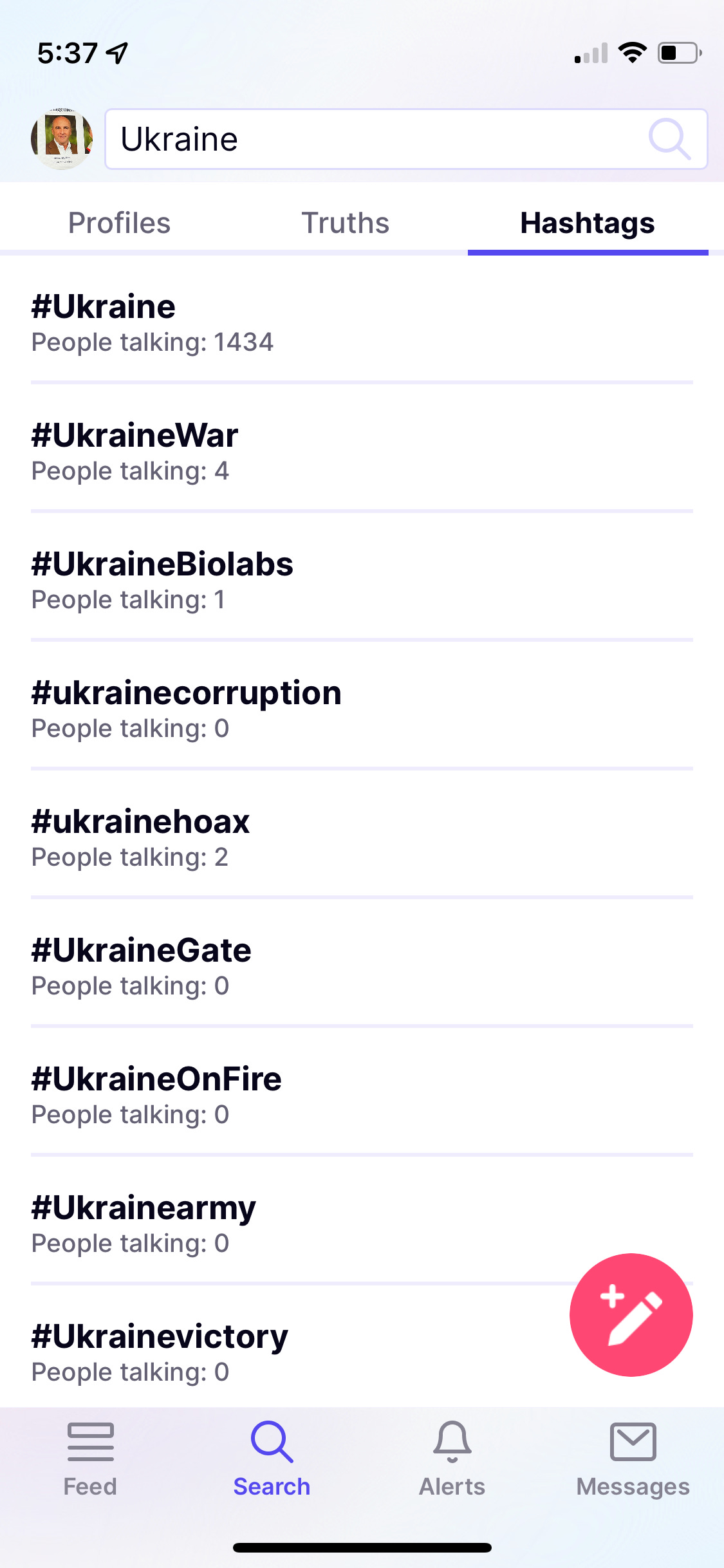

When looking up Ukraine on the app as I often do on Twitter to get updates from reputable sources like the Institute for the Study of War, Truth Social promotes far different content. Without any adjustments, top hashtags say that the “biolabs” hoax is real, that the Bucha Massacre was actually carried out by Ukraine, that dark figures are pocketing resources sent to support Ukraine, and a flurry of bot reposts.

(Note from time of publication: I was going through the feed early this morning to see what I would find, the first five posts in one of the most discussed topics included videos of open surgery on someone and another person falling off a building presumably to their death)

If you just type the letter Q into the search bar, you’re served a mass of Qanon conspiracy accounts to follow, far different than Twitter where you get actual people that just have the letter Q in their usernames.

The moral reprehensibility of the app’s algorithm aside, there are real financial consequences to it as well. The company’s algorithm creates a substantial risk association for advertisers and makes the odds of any material onboarding low. Combined with the issues about the potential userbase size, this makes both the user, CPM, and revenue projections for Truth Social made by the company nothing but a fantasy to me.

95% Downside

These critical problems, which the move to Rumble’s cloud offering does not address, mean that the business model of TMTG is one that I do not believe will achieve profitability.

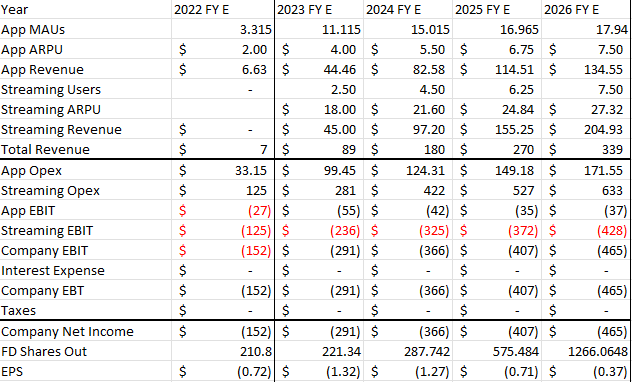

Instead, I believe that the company’s revenue will be a small fraction of its SPAC presentation forecast and that either material share dilution or debt financing will be required to stave off insolvency. The following is my model and assumptions

Truth Social’s MAUs reach 3.315 million in 2022, grow at 150k per week in 2023, with weekly MAU growth slowing by half in each subsequent year

Truth Social’s ARPU will fall well short of expectations due to the issues discussed and be at $7.50 by 2026, closer to Nextdoor than Twitter

TMTG+ will fail to gain meaningful subscriber traction, gaining 2.5 million subscribers in its first year with tapering growth in net adds in the following years

The company won’t have any pricing power. Annual revenue per TMTG+ subscriber starts near Curiositystream’s range at $18, growing at 20% in 2024, 15% in 2025, and 10% in 2026

Total 2024 revenue projected at $180 million, 21.5% of the SPAC’s projections. Total 2026 revenue projected at $339 million, 9.2% of the SPAC’s projections

Truth Social’s operating costs start far higher than revenue and scale down in growth over time, but not to profitability

Operating losses in the Streaming business do not moderate over the projection period

By the end of 2024, the company will be forced to begin severely diluting shareholders, take on debt, or find other financing sources to avoid insolvency at the projected burn rate

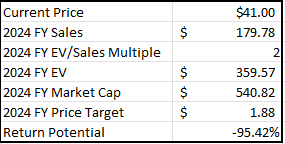

These assumptions lead to my following price target

In a scenario where the SPAC merger goes through, my end of 2024 price target for TMTG is $1.88, representing a downside of over 95% from its most recent closing price despite its over 50% drop since late February.

My EV/Sales multiple of 2x is taken by looking at Netflix’s consensus 2024 EV/Sales of 2.7x, considering the lack of a path to profitability, high industry competition across both business verticals, poor projected ROIC and ROE, as well as the likelihood for dilution or leveraging of the business.

My model uses the base assumption of share dilution rather than debt financing and has diluted shares outstanding grow from its current 210.8 million to 287.74 million by the end of 2024. At my projected burn rates and depressed valuation due to poor results this balloons to over one billion shares by the end of 2026 to keep the business afloat, but that is outside the projection period of the initial price target.

The amount of cash burn on projected cash flows is particularly pertinent to this case as content Capex serves as an accelerator on cash burn much as high investments into building a factory would do the same for a company expanding its production capabilities. This is a prevalent issue across the streaming industry and will come back to bite TMTG particularly hard considering the company’s operational plans and capitalization.

Overall, I see the stock as no different than Trump Hotels and Casino Resorts and view TMTG as having the same outcome. In my opinion, the best-case scenario for the stock is that the SPAC merger is called off, as great reporting from Kerrisdale Capital highlights as possible. That way the stock only goes down 75% instead of 95%.

This article is not investment advice and only represents the thoughts of Strat Becker. You can reach me by email at RealStratBeckerYT@gmail.com, on Twitter @StratBecker, or on Commonstock @Strat. This article is for subscribers of the Due Your Diligence newsletter. If this was shared with you please consider subscribing to receive free stock analysis like this every other Monday.

Disclaimer: I hold no position in Digitial World Acquisition as of the time of publishing, will not take a position in the stock within the next two weeks, and am receiving no compensation to write this article.