Black Rifle Coffee's Red Flags

Pump and dump schemes, restraining orders, and harassment accusations are the norm for this team

Subscribe to DYD to get research that gives you a premium for your time directly in your inbox!

Black Rifle Coffee (NYSE: BRCC - $3.45 billion) is a company that offers direct-to-consumer, ready-to-drink, and retail services to deliver coffee and merchandise to its customers with an emphasis on supporting the military. They are also led by a CFO whose last job was an 18-month stint where he resigned while being sued for stock-price manipulation, a co-founder who had a restraining order instated from a former contractor, alleged sexual harassment from at least two of the company’s three co-founders, and a CEO that appears to be propagating a culture of sexism within the workplace.

That doesn’t even touch the fact that their core business is rapidly decelerating with just single-digit growth expected by 2023, a speculative bet on an experimental retail format that I do not believe will achieve their projected targets, and a valuation that I perceive to be unsustainable. Currently, I see the potential for downside of nearly 50% on the stock.

Management Red Flags

Media coverage on Black Rifle has been nothing but positive since the SPAC merger, and sell-side coverage of the company seems to have taken this hook and sinker

BRCC's stable of executives, segment leaders, and partners are uncharacteristically seasoned for a newly public company, in our opinion. We believe the team will easily step into the "public" arena. (Roth Capital)

Deep leadership team at BRCC: Black Rifle’s management team brings both a broad range of expertise across the consumer and retail industries and also decades of military experience. (D.A. Davidson)

These firms, which have nothing but praise for the management team, missed several red flags about Black Rifle Coffee’s executives. The most glaring of which is the CFO, Greg Iverson, whose last role at Overstock ended with him being sued for stock price manipulation.

The class action complaint, filed in U.S. District Court, names former Overstock CEO Patrick Byrne and former Chief Financial Officer Greg Iverson, along with the company as defendants in an alleged scheme to “deceive the investing public” over a five-month period that ended Sept. 23 of this year. Defendants were motivated to and did conceal the true operational and financial condition of Overstock, and materially misrepresented and failed to disclose the conditions that were adversely affecting the company throughout the class period, the lawsuit states. (Deseret News)

According to the lawsuit, Iverson and Overstock’s CEO at the time were engaged in a scheme to artificially inflate the stock’s price with a plan to issue a “cryptocurrency-issued dividend” that could not be sold for at least six months. This was alleged to punish short-sellers but also allowed insiders to sell shares at an inflated price level. The dividend, which was never actually paid, is not dissimilar to what AMC proponents were trying to make happen with a “special NFT dividend” to “squeeze out the shorts” last year.

In the lawsuit, Iverson is also accused of misrepresenting the financial state of the company to deceive investors. After Iverson resigned on September 17th, it came out that the company was cutting its operating guidance for the year and revealed that demand for its products from customers was weakening. The result? Insiders like the CEO sold over $20 million in stock on the engineered pop and the stock cratered over 65% in the months following his resignation.

It is beyond me how analysts offering their services to the public could miss such a red flag that took only rudimentary research to find out, especially considering there are other serious concerns with the leadership of the company. One of the co-founders had a restraining order in place from a former contracted employee of the business, more than one of the co-founders, including those in relationships are alleged to have been trying to sleep with contracted employees, and all co-founders including the CEO have allegations of harassment and promoting a sexist workplace culture against them.

To be clear, the only one of these that can be confirmed as true is the existence of the restraining order made by Nicole Arbor as that is part of a court document. The other pieces are just allegations, but public conduct from the co-founders makes me believe that their behavior may have a material impact on the company’s ability to achieve its operational objectives.

Take this comment from the CEO calling a woman a “dumpster” followed up with another co-founder of the company laughing about it. From what I can ascertain, these are not isolated incidents of poor behavior. While I believe there are serious moral issues at hand, I also believe that business execution concerns from these actions stem from how this impacts the culture of the business. With male employees sending female employees birthday cakes like this, it seems apparent that a broader culture of mistreatment and neglect may be the norm for Black Rifle Coffee.

Operational Red Flags

While management has several red flags, the company’s operational performance and statements in public releases raise similar concerns. Firstly, the core DTC business is rapidly decelerating. Currently composing over 70% of the company’s sales, this segment almost doubled sales in 2020. However, this growth fell to under 20% in 2021. In the company’s SPAC forecast they call for growth to keep this quick decline, down to under 13% forecast for 2022 and just 8.2% forecast for 2023. Considering the company is not profitable, the rapid decline of growth in their core business in the SPAC release is alarming.

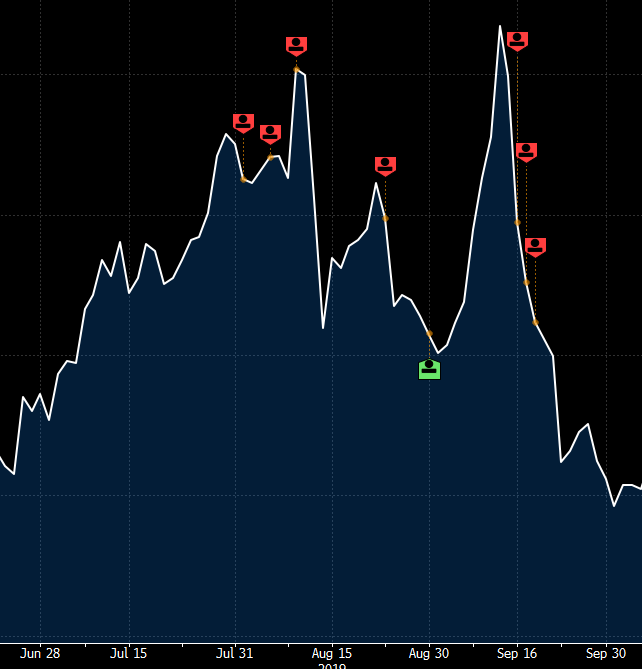

Despite themselves forecasting quick deceleration of growth, information indicates that this growth may decline further than the company claims. Web traffic trends from sites like SemRush show that monthly traffic to Black Rifle Coffee’s site declined during December and January and was also facing declines in September and October before news of their SPAC merger brought a temporary surge in clicks.

The struggle to keep traffic up matches their over 75% decline in engagement on YouTube. Consistently getting over 4 million views and 20,000 subscribers a month as recently as May, the company only generates under 800,000 monthly views and almost no subscriber gains today. This slowdown is apparent across all their social media platforms and materially harms their ability to drive potential customers to their site. Despite advertising their following in investor presentations as a key driver of sales, the large decline in the effectiveness of their content in driving clicks could be a leading indicator of a larger than expected slowdown in their DTC business.

With a lack of success from their social media content, the company will likely have to spend more than expected on marketing to make up for the lost sales opportunities. Currently, the company expects marketing as a percent of sales to decline from 14.7% to just over 10% over the next two years. Unless they can turn around their engagement issues on their social media channels, this seems like an unrealistic expectation.

Like the struggles in their core business, the experimental “outpost” model which the company claims will be responsible for 39% of its sales growth in the next two years has potential execution issues. At this time, the company claims that opening a store will cost $1.5 million. However, with persistent supply chain issues, a renewed rise in the cost of building materials, and a CFO who has a history of obscuring the truth, I struggle to find this claim or the claim that each unit will have 45%+ cash-on-cash returns reliable.

It is seriously possible that the costs for these stores are higher than anticipated with longer timelines to opening. Businesses in all parts of the economy have faced delays in construction and higher than expected costs, from food manufacturers, to grocers, and more. There is no specific reason to expect Black Rifle Coffee to avoid these issues. Knowing that most of the cash from the SPAC merger is going into something that can be considered experimental and unproven according to the company’s own risk factors is a significant concern.

Furthermore, it is of my opinion that rapidly scaling these stores will cannibalize individual unit performance when considering the abundance of already existing coffee stores that could cause oversaturation. The company already believes its AUV per unit will decline from $2.5 million to $2.3 million in 2023, but the potential for this to fall further is very real. I also believe this problem will result in their contribution margin, which is already below that of the recent coffee IPO Dutch Bros, shrinking from its current 25% level in the coming years.

Valuation

With all these issues and the company currently being unprofitable, the fact that the stock currently trades at about eight times the street consensus EV/Sales multiple for 2023 stands out. This could be influenced by the low-float nature of the stock at the time of writing as lockups among other factors limit the number of shares on the market to trade. Regardless, it creates a scenario where material downside is possible in my model.

The following are my assumptions

Revenue for all segments does not meet expectations and company-wide sales fail to grow at 30% in either of the next two years

The company fails to improve its COGS margin in the face of inflationary pressures

Failure to accelerate social media engagement means marketing as a % of sales does not decline

The result of these assumptions is a serious discrepancy in my estimates from the three sell-side analysts currently covering the company. While sell-side believes the company’s SPAC presentation of sales is at $430 million in 2023, I forecast sales of over 11% less at around $382 million. The other notable differences come in cost forecasting which I believe will not be as disciplined, with the company generating widening losses into 2023 vs the street’s expectation of a turn to profitability.

Because I don’t anticipate the company being net, EBIT, or EBITDA positive by the end of 2023, I must use an EV/Sales multiple in my valuation. This multiple was achieved by calculating the mean 2023 EV/Sales multiple of Starbucks, Celsius, and Monster. This comes out to a multiple of 5.25x.

However, I wanted to include other profitability and growth measures to make a more sound determination on what multiple should be given. I concluded that the materially slower growth for Black Rifle Coffee that is forecast compared to Celsius, the substantially lower profitability compared to Monster, and the dependence of future growth being in more capital heavy segments like Starbucks make Black Rifle Coffee deserve a discount to the average valuation multiple, and the 5.25x average from the three companies was cut by 10% to reflect this. The ending EV/Sales multiple I use in this model is 4.73x.

Combining my sales forecast with a 2023 EV/Sales multiple of 4.73x gives an end of 2023 price target of $9.42. This indicates potential downside of almost 50% from Black Rifle Coffee’s closing price of $18.78 on February 18th. In contrast, the lowest sell-side price target currently is at $13. Notably, all three sell-side analysts rate the stock as a buy as of the time of writing despite their expected returns being negative.

While valuation is harder to forecast than earnings, I believe that the failure of the company to achieve its stated goals due to the red flags I’ve noted will cause the valuation given to the company to contract over time.

In closing, Black Rifle Coffee has seen its stock perform spectacularly since its SPAC merger closed in the past weeks. Despite this, red flags in management and operational performance lead me to believe that the stock is seriously overvalued with considerable downside possible for it as reality takes hold.

This article is not investment advice and only represents the thoughts of Strat Becker. You can reach me by email at RealStratBeckerYT@gmail.com, on Twitter @StratBecker, or on Commonstock @Strat. This article is for subscribers of the Theta Thoughts newsletter. If this was shared with you please consider subscribing to receive free stock analysis like this every Monday.

Disclaimer: I hold no position in Black Rifle Coffee and am receiving no compensation to write this article.

What process do you use when doing your DD on these companies and finding this information. What are your go-to sources?

Do you know of any good studies/writeups on using webtraffic data as a leading indicator? I've seen it done all the time, just wonder how useful it actually is. I enjoyed the writeup although the low float seems to make shorting difficult